Virtuals Protocol (VIRTUAL) is down 15% in the last 24 hours after rallying an impressive 200% over the past 30 days. This pullback comes as the token tests a key resistance level around $1.53, while trend indicators show signs of weakening momentum.

At the same time, Smart Money wallets have increased their holdings by 14.4% in the last week and have held steady since May 2—suggesting confidence in the longer-term outlook. VIRTUAL stands at a technical and psychological crossroads. Traders are watching closely to see whether it can build toward a breakout above $2 or slide back to support at $1.19.

Smart Money Holds Steady as VIRTUAL Pulls Back 15%

The number of VIRTUAL tokens held by Smart Money wallets on Ethereum has increased by 14.4% over the past week, rising sharply from 16.49 million to 18.57 million on May 2, and remaining steady around 18.54 million since then.

Despite its recent price pullback, this growth signals that some of the most sophisticated on-chain participants have been accumulating exposure to VIRTUAL.

The sharp rise followed by stability suggests Smart Money wallets may be holding in anticipation of further upside, especially after the token posted a 209% gain in the last 30 days, making it one of the best-performing altcoins in the market.

The recent 15% dip in the last 24 hours hasn’t yet triggered widespread selling among these wallets, which may reflect patience rather than panic.

This holding pattern could signal confidence in continuing the broader uptrend or at least a strategic pause before reallocating.

While not guaranteeing future gains, steady Smart Money holdings in the face of short-term volatility are often a positive signal for longer-term momentum.

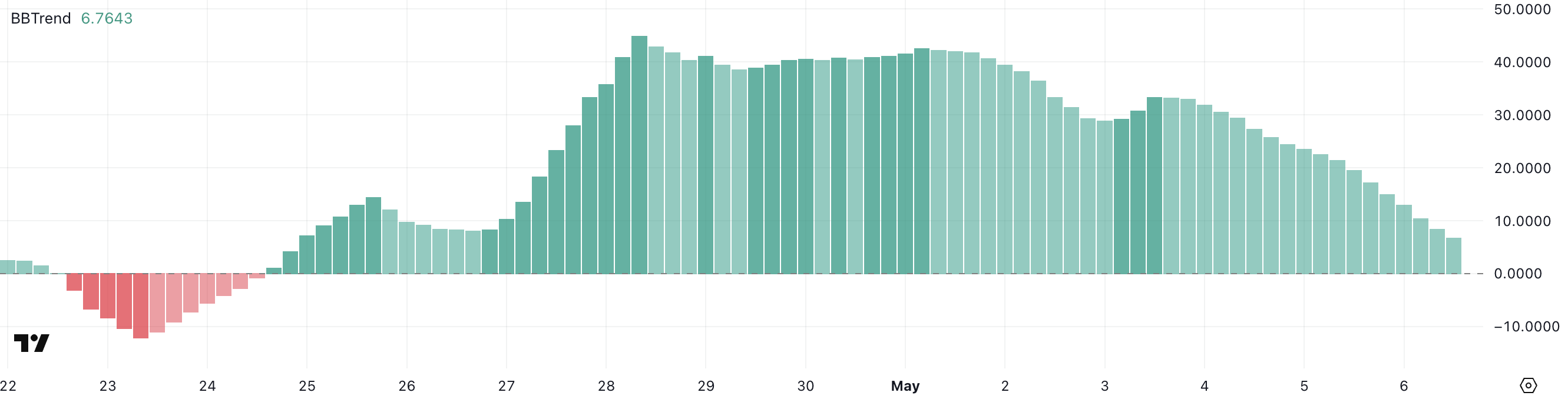

VIRTUAL BBTrend Drops Sharply—Is Momentum Fading?

VIRTUAL’s BBTrend has sharply declined to 6.76, down from 31.91 just two days ago, marking a significant weakening in upward momentum.

The BBTrend (Bollinger Band Trend) is a volatility-based indicator that measures the strength and direction of a trend by analyzing the expansion and contraction of Bollinger Bands.

Values above zero suggest a bullish trend, with higher readings indicating stronger momentum. Since April 24, VIRTUAL’s BBTrend has stayed in positive territory—signaling consistent bullish behavior for nearly two weeks.

The current reading of 6.76 still reflects a positive trend, but the steep drop shows that momentum is cooling off. While this doesn’t necessarily signal an imminent reversal, it suggests that the explosive pace seen in recent days is slowing.

After a 193% surge in the past month, this deceleration may point to a period of consolidation or reduced buying interest.

Traders should watch whether the BBTrend continues to decline or stabilizes—either could shape whether VIRTUAL regains strength or dips further.

At a Crossroads: Will VIRTUAL Breakout Above $2 or Pull Back to $1.19?

VIRTUAL is currently trading just below a key resistance level around $1.53. If buying momentum returns—particularly with renewed interest in crypto AI agents—VIRTUAL could test $1.89 in the near term.

A successful breakout there would pave the way for a possible move above the $2 mark, a level it hasn’t reached since January 30.

However, failure to reclaim $1.53 could lead to a pullback, especially given the recent cooling in trend strength.

In that case, the next key support level lies at $1.19.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Be the first to comment